You S. gold supplies strike $step 1 trillion inside the really worth once list rally

Content

On the 1970s, gold rates surged after the President Richard Nixon’s choice to end the new Bretton Trees repaired change-price monetary program, which in fact had pegged the newest buck so you can silver. When you’re nothing ones items has totally fixed, going back few days provides seen the buck regular plus the flareup as a swap stress ranging from China plus the You simplicity. Any historic production, requested output, or possibilities forecasts will most likely not reflect real future efficiency.

Volatile Bonuses You to Prepare a slap

Request are driven from the each other commercial include in green time and you will technology and you will revived secure-refuge money interest,” he said. Our very own products are replaced for the margin and bring a top height of risk and is you can to reduce all your money. These things may possibly not be right for individuals and you will ensure that you see the risks in it. David Chao out of Invesco Advantage Management demanded over weight ranks inside the silver because the a great hedge up against the You buck, recommending you to investors keep up to 5% of their portfolios inside gold. If you are questions is actually building more than just how long gold’s listing rally can also be past, greatest forecasters try optimistic across the red metal’s mindset.

A week Attitude: You.S. Shutdown, Fed Split, Silver Rally, and you will Worldwide Actions

Analysts additional that this season’s gold rally might have mrbetlogin.com try these out been stronger from the list profile from authorities financial obligation. Silver rates went on so you can rise to your Saturday, hitting an alternative list highest since the You.S. government shutdown hit the 6th go out. The fresh powerful development “suggest a wider pattern away from a great rotation on the ‘tangible places of value’ over the gold and silver coins cutting-edge,” Hansen composed. Remarkably, they haven’t yet read its example, because they are all of the back parroting their dated mantra from main banking institutions. Well, naturally, one silver blog post wasn’t viewed positively from the customers from the go out. Actually, I was summarily advised in the statements area that we know absolutely nothing concerning the silver otherwise monetary places.

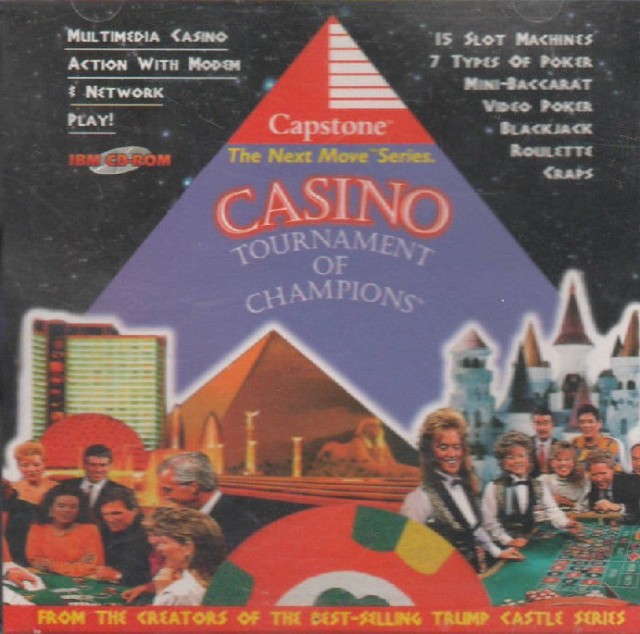

- Black-jack RTP is actually impressively large which means you you are going to stand to and acquire $99.59 once you wager $one hundred.

- In other words, highest prices are causing real gold to go in a rush.

- The newest sound recording, having its twangy banjo music and clinking gold coins, very well captures the brand new soul out of a busy boundary town, and then make all of the training feel just like an enthusiastic adventure.

- BillMeLater also will bring customers with alerts and you may systems to assist them to manage their costs.

- One historical output, expected productivity, or chances projections may not echo real coming overall performance.

You may enjoy the coziness of your property and you may spin the brand new reels of the Gold Rally position. Once we already told you, don’t try to judge the overall game by the the seems – it might seem small and effortless, yet it offers some good features to amaze you. First of all, it exploration-themed slot are visually exciting, otherwise say more, plus the images employed for the newest icons will certainly leave you smile.

An environment out of caution features seeped for the segments recently since the questions ripple to the AI change, that have issues on the AI using and a possible dot-com-build bubble. At the same time, the new federal stoppage continued to breed suspicion, no prevent on the gridlock in sight while the President Trump threatens so you can withhold back buy furloughed government experts. “Silver is detected by many people market people because the a safe-sanctuary advantage. But people need to be alert it offers a good volatility out of 10-15%,” Staunovo listed. He extra one a small amount out of bodily silver, for example coins otherwise step one-gram pubs, has big ranges ranging from exchanging prices. Analysts point out strong silver consult of main banks within the community in the midst of increased geopolitical tensions, such as the lingering conflicts inside the Gaza and you will Ukraine. Which have interest rates relatively going straight down, silver is far more attractive while the a monetary resource while the buyers are not missing out to your highest output out of Treasuries or other authorities bonds, he advised traders in the a report.

If you will be to experience Silver Rally in hopes from profitable the video game’s progressive jackpot, just be to play during the restriction share. Again, just professionals gambling from the limitation stake be eligible for the new modern jackpot. Karolis Matulis is an Seo Content Editor in the Gambling enterprises.com with well over six many years of experience with the web gaming industry. Karolis features written and you can modified dozens of slot and you may casino ratings and it has starred and examined a large number of online position game.

Tomato cost exceed poultry beef within the Karachi

The financial institution cited a continuing also have deficit, to the Silver Institute estimating one to 2025 usually draw the brand new 5th successive year out of structural lack, that have a good shortfall of about 118 million oz. Motilal Oswal wants gold in order to combine ranging from $50–55 per ounce over the 2nd several months, with potential highs in the $75 from the 2026 and suffered path to the $77 inside 2027 on the COMEX. And when the typical USD/INR out of 90, the fresh broker ideas domestic cost to reach Rs 2,40,100 by end-2026 and Rs dos,46,100000 within the 2027. The fresh outperformance provides kept antique assets far about — silver ETFs has attained simply 63% this season, if you are standard security indicator, Sensex and you can Great, provides brought modest production out of 6–7%. Gold’s rally was also fuelled by Chairman Donald Trump’s exchange and you can geopolitical formula, that have inspired an excellent fifty% surge along the year. Trump’s aggressive moves caused a trip to shelter and a shift out of the money.

Obviously, the new macroeconomic and you will geopolitical climate in the 1st 50 percent of the fresh seasons will eventually dictate the fresh guidance out of traveling to possess silver, with many cautiously gaming to your an ascending rates trajectory for an currently pricey precious metal. Highest interest rates can get slow down the appeal away from gold to own investors however it is in addition to considered hedge facing widespread rising cost of living. Of course, the fresh U.S. interest rate attitude was an initial driver of one’s guidance of the silver price. The brand new Provided reduce cost during the rate in the Sep, November and December but also hinted during the a lot fewer slices for 2025.

All of us stocks marched higher to the Wednesday since the Wall surface Road returned to rally function if you are investors digested the new Federal Reserve times to render ideas in order to future plan in the midst of a great shutdown-determined lack of information. “The new gold rally started in 2022,” Giovanni Staunovo, item specialist during the UBS International Wide range Government, told you thru email to your Tuesday. The new “lead to area” for the raise is actually if U.S. or other West partners relocated to frost around $300 billion away from Russian overseas holdings at the beginning of the fresh war inside Ukraine, he added. “Enhance that fact that ore levels is dropping, the increased use of these types of points from production signifies that silver would be greatest from the securing to purchase strength.” “$4,100000 an oz looked much-fetched in the very beginning of the year because the gold registered 2025 near $2,800 an oz. However, just after a ~50% rally, right here we have been,” eToro You.S. financing specialist Bret Kenwell told you inside a message.