The Power of Leverage in Forex Trading Maximizing Your Investing Potential

Leverage is one of the most powerful tools available to forex traders, allowing them to control larger positions with a smaller amount of capital. Understanding how to use leverage effectively can be the difference between a successful trading career and a series of disappointing losses. In this article, we will delve into the intricacies of leverage in forex trading, detailing how it works, the benefits and risks associated with it, and strategies to optimize your trading experience. To start off, you can visit leverage in forex trading trader-apk.com for additional resources that can help you enhance your trading skills.

What is Leverage in Forex Trading?

Leverage in forex trading refers to the ability to control a larger position in the market with a relatively small amount of own capital. It is expressed as a ratio, such as 100:1, which means that for every $1 you put up, you can control $100 in the market. Essentially, leverage enables traders to magnify their potential profits without needing to commit a lot of their own funds upfront. This is particularly advantageous in the forex market, where currency prices often only move slightly within a trading day.

How Leverage Works

When you open a leveraged position, you are essentially borrowing funds from your broker to increase the size of your trade. For instance, if you choose a leverage of 100:1 and deposit $1,000 into your trading account, you can control $100,000 worth of currency. If the trade goes in your favor, the profits can be substantial due to the larger position size. However, it’s crucial to note that losses are also magnified, which can lead to significant financial risks.

The Advantages of Using Leverage

There are several advantages to utilizing leverage in forex trading:

- Increased Potential Profits: By using leverage, traders can significantly enhance their profits on favorable trades without needing to invest large sums of capital.

- Accessibility: Leverage allows traders with limited capital to participate in the forex market, which might otherwise be out of reach.

- Diversification: With a smaller amount of capital required for each trade, traders can diversify their portfolios more effectively across different currency pairs.

- Flexible Capital Utilization: Leveraged trading frees up capital that can be used in additional investments, thus optimizing the overall investment strategy.

The Risks of Using Leverage

While leverage offers several benefits, it also comes with significant risks. Understanding these risks is essential for every trader:

- Increased Losses: Just as leverage can amplify profits, it can also magnify losses, leading to a rapid depletion of trading capital.

- Margin Calls: If the market moves against you, your broker may issue a margin call, requiring you to deposit more funds to maintain your position or risk having it closed automatically.

- Emotional Trading: The pressure of managing a leveraged position can lead traders to make impulsive decisions based on fear or greed rather than sound trading strategies.

- Market Volatility: The forex market is inherently volatile. Sudden price shifts can result in unexpected losses when trading on leverage.

Strategies for Effective Use of Leverage

To maximize the benefits and mitigate the risks of leverage in forex trading, consider implementing the following strategies:

- Use Lower Leverage: Opting for lower leverage ratios can help manage risks. A leverage of 10:1 or 20:1 can still yield significant profits while reducing exposure to extreme losses.

- Implement Stop-Loss Orders: Always use stop-loss orders to protect your capital. This automated order will close your position at a predetermined price, limiting potential losses.

- Focus on Risk Management: Determine your risk tolerance and stick to it. Never risk more than a small percentage of your total trading capital on a single trade.

- Develop a Trading Plan: A well-defined trading plan helps in outlining your strategy, including entry and exit points, risk management techniques, and leverage usage.

- Educate Yourself: Continuous education in forex trading, market analysis, and understanding the mechanics of leverage will empower you to make informed decisions.

Practical Examples of Leverage in Forex Trading

To illustrate how leverage works in practice, let’s consider a hypothetical example:

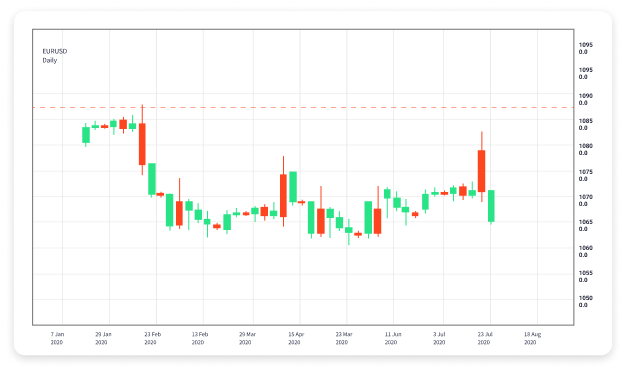

Suppose you have $1,000 in your trading account and decide to use leverage of 100:1. You enter a long position on the EUR/USD pair at a price of 1.2000, which allows you to control a position size of $100,000. If the market moves in your favor and the EUR/USD rises to 1.2050, the profit from your trade would be:

Profit = (New Price – Opening Price) x Position Size

Profit = (1.2050 – 1.2000) x $100,000 = $500

However, if the price moves against you and drops to 1.1950, your losses would be:

Loss = (Opening Price – New Price) x Position Size

Loss = (1.2000 – 1.1950) x $100,000 = $500

In this instance, even a small price movement results in a profit or loss that equals 50% of your capital. This example emphasizes the importance of prudent risk management.

Conclusion

Leverage in forex trading can be a double-edged sword. While it provides the opportunity to amplify profits, it also exposes traders to enhanced risks. Successful forex trading requires a comprehensive understanding of how leverage works, the associated risks, and effective strategies for its application. By using leverage thoughtfully and implementing robust risk management practices, traders can navigate this high-stakes environment and work towards achieving their financial goals. Continuous learning, discipline, and practice will further aid traders in harnessing the benefits of leverage while keeping risks at a manageable level.