How to Deposit a Iron Man 2 online casinos on the a mobile Software

Content

If you are using the new QRC ability specific info is collected out of your own mobile device to own company objectives. There’s no more payment for using Mobile View Put, however, it is recommended that your consult with your company in order to find out if you will find any cordless service provider charges. Cellular put allows you to complete pictures of one’s front and back of your own recommended, qualified consider. You’ll save time with a lot fewer travel to a good Wells Fargo Atm otherwise part.

Ally Lender Spending Account – Iron Man 2 online casinos

Yes, you could put a personal consider using the cellular app if you have a combined membership. You may need to features each other account holders promote the brand new view ahead of deposit they. Yes, specific banking companies has a limit to your quantity of checks your is also put a day otherwise a month utilizing the cellular app.

Log in to the Investment You to definitely Cellular banking application and choose the fresh membership you want to deposit the new check into, following click on the Put alternative next to the digital camera icon. Following, type in the newest put number and every other questioned guidance. The kinds of inspections you might put may vary depending on and this standard bank you employ. Such as, Financing One people is essentially put You.S. personal, business or regulators checks making use of their Investment You to definitely Cellular application. Along with, can it be a secure solution to put money in your Investment One account?

You’ll can endorse a, ideas on how to get a pictures of the take a look Iron Man 2 online casinos at using your software and the ways to deal with common demands that may develop. Banking institutions do not demand restrictions for the amount of money you to you might put in one purchase. Yet not, once you build an enormous take a look at deposit your bank is place a hold on tight the funds. At the same time, if you make an enormous dollars put you may have to compete with processing charge. There are not any restrictions to the sum of money you could potentially put into the checking otherwise savings account. With the exception of several conformity, the whole process of depositing most money is similar to this of smaller amounts.

- If you’d like in order to automate your own income places, you may choose to benefit from direct put.

- If your financial offers cellular consider deposit and you haven’t tried it yet, discover the new application the next time you receive a.

- Get to know the financial’s cellular app functionalities.

- Extremely banking institutions only accept monitors on the local currency to have mobile deposits.

- You can find deposit limits, and so they trust the brand new deposit strategy.

- Key Bank and TD Financial, such as, costs an excellent dos% commission for immediate access, while you are Places Bank costs as much as cuatro%.

Speak to your lender observe the policy to own carrying dumps and exactly how rapidly your own mobile look at deposits will be clear. Hopefully this informative article have assisted you to definitely find the mobile look at put limits at the major banking companies such as the you to definitely you bank with. After you’re equipped with this knowledge, you could potentially rest assured knowing your own consider tend to deposit as opposed to topic. Just be sure which you’lso are logged into your best banking app before starting taking photographs and you may posting her or him.

Get your financial’s cellular application

It is since the secure and safe as the placing a within the individual, if you take care to keep the passwords and you may other electronic advice safer. Wells Fargo mobile deposit brings a quick, free and you can safe way to deposit monitors. As a result of the number of other useful features on the application, you’re also attending realize that mobile financial is practical not merely to possess deposits, however for full account administration also. Wells Fargo cellular put offers a simple and safer ways to add money on the put account using the camera to the their cellular telephone or any other mobile device.

GOBankingRates works with of several economic entrepreneurs to program items and you may services to the viewers. Such brands make up me to market their products or services inside advertisements around the our very own webpages. So it payment could possibly get feeling exactly how and you will in which issues appear on it web site. We are not an assessment-equipment and these also offers don’t represent all of the available deposit, funding, mortgage otherwise borrowing from the bank things. Atm machines are designed to deal with places and you may inspections for on the one number. If you do have an enormous look at so you can bucks, a huge greater part of the cash can be stored before you can can make use of them.

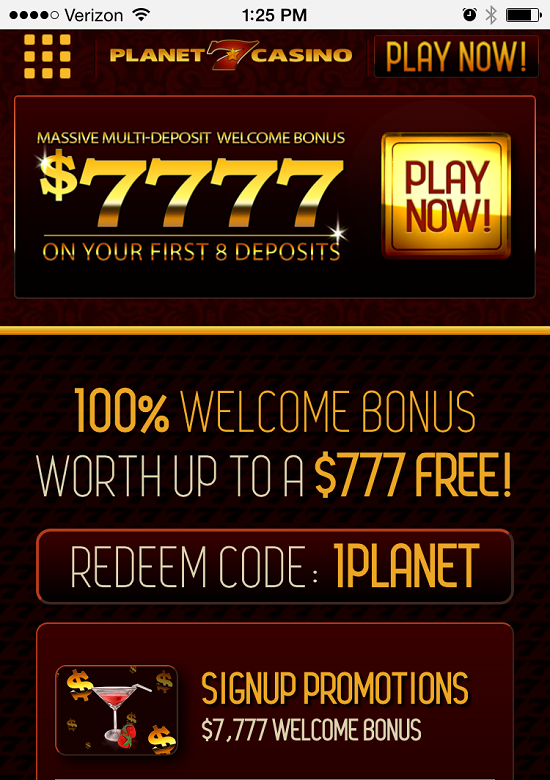

It gambling establishment states which operates Real time cam within the English code at least couple of hours every single business date. Celebrity get are member of the Fruit App Store score to the Find cellular application which can be up-to-date every day. The essential difference between “Depositor” and you may “Recorded by the” merely applies to put account with a reliable Representative listed. For these purchases, an important membership holder’s name is displayed because the “Depositor” as well as the Trusted Member try demonstrated because the “Submitted because of the.” Realize your account contract very carefully and look with your standard bank. Consult with your financial institution or your bank account arrangement observe which cheques you could put having fun with electronic put.

Of numerous date buyers want to make cellular money dumps while on the newest go, tend to having fun with a general public Wi-Fi relationship, which’s incredibly important of your preference a brokerage with a high-level protection. It’s not recommended to deposit another person’s check out the membership because when you deposit a, you’re endorsing they and you can guaranteeing you have suitable for the cash. Depositing another person’s check into your account would be thought fake interest.